Ivanhoe Electric Announces Completion of Earn-In to Acquire a 60% Interest in the Samapleu-Grata Nickel-Copper Project in the Ivory Coast

March 25, 2024

Ivanhoe Electric Announces Completion of Earn-In to Acquire a 60% Interest in the Samapleu-Grata Nickel-Copper Project in the Ivory Coast

![]()

Joint Venture Partner Sama Resources Announced a New Preliminary Economic Assessment for the Project Delivering a Pre-tax NPV8 of US$463M and a Pre-tax IRR of 28.2%, with an Estimated Initial Capital Cost of US$338M

![]()

The Project has the Potential for a 16-Year Mine Life Producing a Conventional 26% Copper Concentrate and a 13% Nickel Concentrate, with Associated Platinum, Palladium and Cobalt By-Products

PHOENIX, ARIZONA – Ivanhoe Electric Inc. (“Ivanhoe Electric”) (NYSE American: IE; TSX: IE) Executive Chairman, Robert Friedland and President and Chief Executive Officer, Taylor Melvin are pleased to announce today that Ivanhoe Electric has completed its earn-in to acquire a 60% interest in the Samapleu-Grata Nickel-Copper Project in the Ivory Coast (“Project”). On March 21, 2024, Ivanhoe Electric’s joint venture partner at the Project, Sama Resources Inc. (“Sama”) (TSXV: SME), disclosed a new 2024 preliminary economic assessment for the Project (“2024 PEA”) in accordance with National Instrument 43-101.

The Samapleu-Grata Nickel-Copper Project is now a 60/40 joint venture between Ivanhoe Electric and Sama. In addition to a 60% interest at the Project level, Ivanhoe Electric also owns 22.7% of the common shares of Sama.

Mr. Taylor Melvin, President and CEO of Ivanhoe Electric commented: “We are pleased to have completed our earn-in to 60% of the Samapleu-Grata Nickel-Copper Project. We are particularly encouraged by the significant improvement in both the quality and quantity of potential future copper concentrate production at the Project compared to earlier studies. The results announced by our joint venture partner, Sama, are a product of the hard work by our dedicated joint team. We look forward to working together with Sama on the next steps for our high-quality nickel-copper Project.”

A full copy of Sama’s press release for the 2024 PEA can be found here.

The Samapleu-Grata Nickel-Copper Project

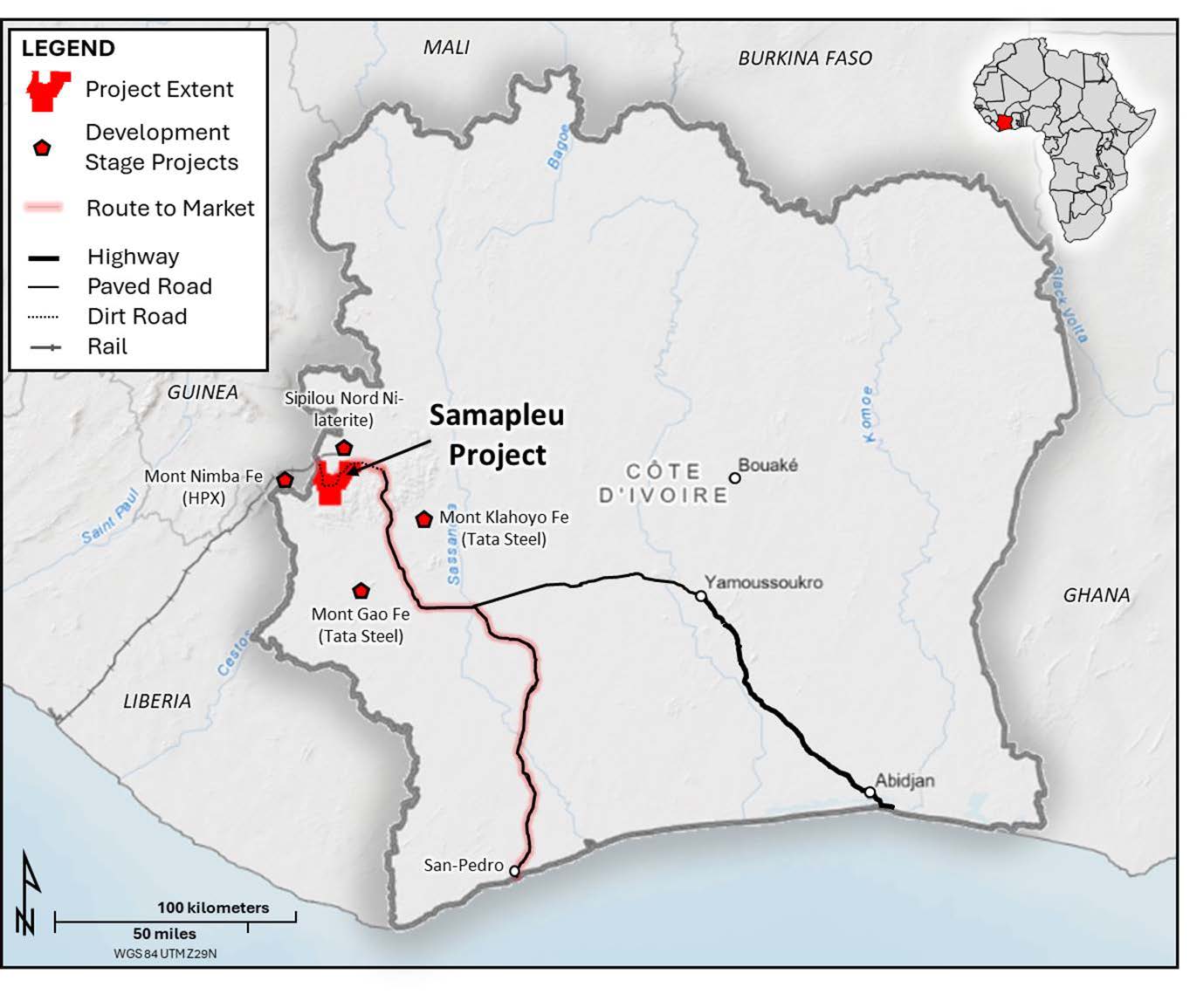

The Samapleu-Grata Nickel-Copper Project is located in western Ivory Coast approximately 600 km from the capital Abidjan. The total area of the Project is approximately 835 km2.

Ivanhoe Electric entered into a binding term sheet for an earn-in and joint venture agreement with Sama which was subsequently formalized in March 2021. Ivanhoe Electric satisfied the terms of its 60% earn-in by spending C$25 million by March 2024.

Figure 1: Samapleu-Grata Nickel-Copper Project Location in Côte d’Ivoire

Highlights of the 2024 Preliminary Economic Assessment Announced by Sama Resources

The 2024 PEA outlines the potential for a conventional open pit mining operation supporting 86.5 million tonnes of modelled mill feed together with 1.62 million tonnes of direct shipped laterite material entirely from the Grata, Main and Extension deposits and the Sipilou Sud Laterite deposit.

Over the life of mine, the Samapleu-Grata Nickel-Copper Project would produce an annual average of 38,627 tonnes of a 26% copper concentrate and 55,119 tonnes of a 13% nickel concentrate through a process plant with a capacity of 5.475 million tonnes per year. This would be achieved through a conventional process that focusses entirely on flotation, for the production of separate copper and nickel concentrates together with cobalt, platinum, palladium and gold as by-products.

Highlights from the 2024 PEA announced by Sama Resources include:

- Average annual production of approximately 38,627 tonnes of 26% copper concentrate and 55,119 tonnes of 13% nickel concentrate

- Average annual nickel metal in concentrate of approximately 7,165 tonnes per year and copper metal in concentrate of approximately 10,043 tonnes per year

- 16 year-life of mine

- Pre-tax Net Present Value (“NPV”) at an 8% discount rate of US$463M and internal rate of return (“IRR”) of 28.2%

- Post-tax NPV8 of US$257M and post-tax IRR of 22.3%

- Initial capital costs of US$338M including a contingency of US$61M

- Post-tax payback period of 3.8 years

The 2024 PEA is based on a long-term nickel price of US$8.83/lb and a long-term copper price of US$3.99/lb.

The 2024 PEA is preliminary in nature and includes inferred mineral resources, considered too speculative in nature to be categorized as mineral reserves. Mineral resources that are not mineral reserves have not demonstrated economic viability. Additional trenching and/or drilling will be required to convert inferred mineral resources to indicated or measured mineral resources. There is no certainty that the results of the 2024 PEA will be realized.

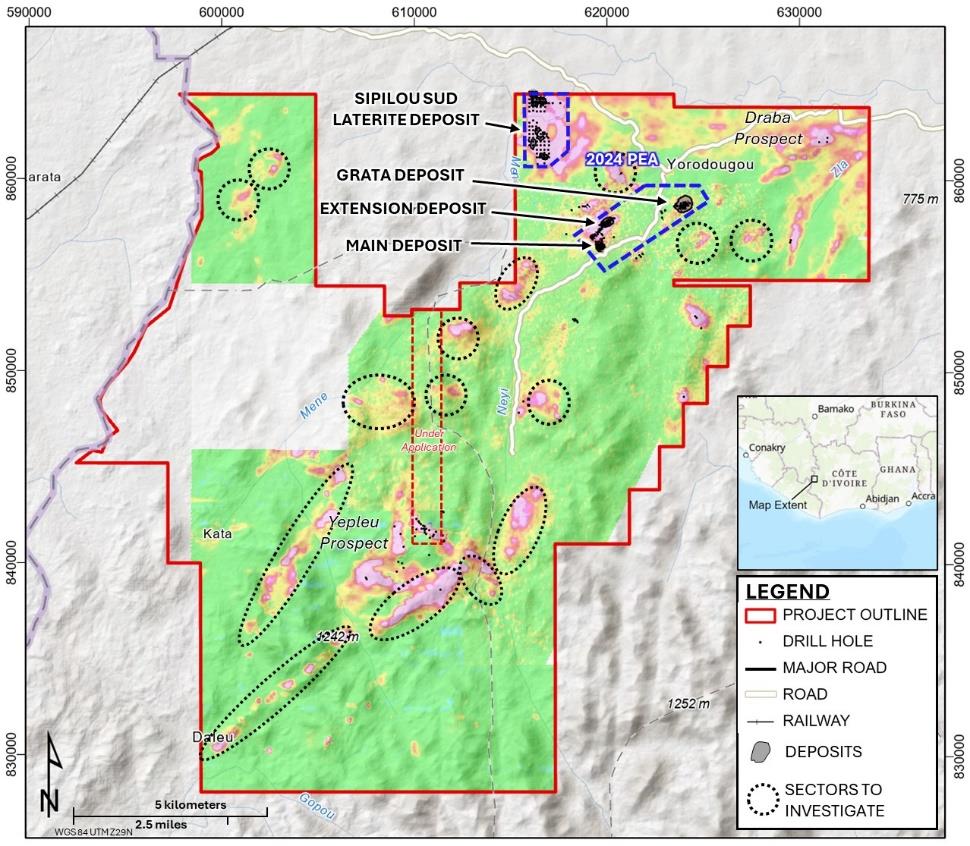

The 2024 PEA includes only the Grata, Main and Extension deposits and the Sipilou Sud Laterite Deposit, which together with the proposed mine infrastructure, covers only approximately 3% of the 835 km2 Project area. This provides ample opportunities for exploration upside and expansion opportunities, including at known mineralized zones at Yepleu and Draba, as shown in Figure 2.

Figure 2: Samapleu-Grata Nickel-Copper Project Highlighting Areas Included in the 2024 PEA and Known Prospective Sectors for Further Exploration

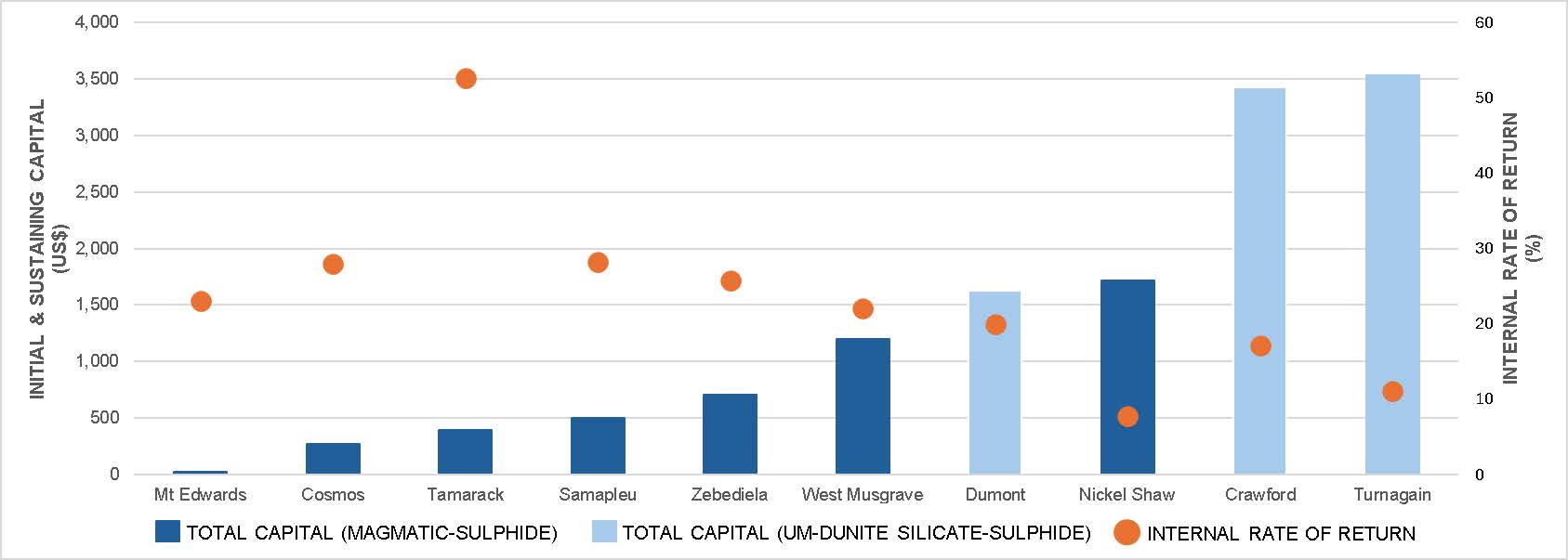

The Samapleu-Grata Nickel-Copper Project is a potentially commercially profitable operating open-pit operation consisting of magmatic polymetallic sulfide mineralization with by-product metals, including copper, gold, cobalt, platinum, and palladium. The Project has a comparatively small capital cost and favorable internal rate of return while producing competitive nickel and copper concentrates.

Figure 3 compares the Project’s total estimated capital and pre-tax IRR against other pre-production nickel assets, including primary magmatic sulfide deposits like Tamarack, as well as the bulk-tonnage low-sulfur, ultramafic-hosted deposits like Dumont and Crawford. Based on the 2024 PEA, the Samapleu-Grata Nickel-Copper Project has one of the lowest total capital costs while producing a pre-tax IRR that is second only to the Tamarack deposit in the United States providing the opportunity to construct a relatively small, but comparably profitable polymetallic mining operation.

Figure 3. Total Capital and Pre-Tax IRR for Selected Pre-Production Nickel Deposits

Source: S&P Capital IQ database; company reports and presentations.

Finally, the polymetallic nature of the Samapleu-Grata Nickel Copper Project means that it has the potential to produce not only a nickel concentrate, but a high quality 26% copper concentrate that is on par with the copper concentrate produced from primary copper mines.

Qualified Persons

Disclosures of a scientific or technical nature included in this news release, including the information regarding the 2024 PEA have been reviewed, verified and approved by Mark Gibson, P.Geo. and Mr. Glen Kuntz, P.Geo. Each is a Qualified Person for the purpose of National Instrument 43-101 and Regulation S-K, Subpart 1300 promulgated by the U.S. Securities and Exchange Commission. Mr. Gibson is the Chief Geophysics Officer for Ivanhoe Electric and Mr. Kuntz is the Senior Vice-President, Mine Development for Ivanhoe Electric. Neither Mr. Gibson nor Mr. Kuntz is considered independent.

About Ivanhoe Electric

We are a U.S. company that combines advanced mineral exploration technologies with electric metals exploration projects predominantly located in the United States. We use our accurate and powerful Typhoon™ geophysical surveying system, together with advanced data analytics provided by our subsidiary, Computational Geosciences Inc., to accelerate and de-risk the mineral exploration process as we seek to discover new deposits of critical metals that may otherwise be undetectable by traditional exploration technologies. We believe the United States is significantly underexplored and has the potential to yield major new discoveries of critical metals. Our mineral exploration efforts focus on copper as well as other metals including nickel, vanadium, cobalt, platinum group elements, gold and silver. Through the advancement of our portfolio of electric metals exploration projects, headlined by the Santa Cruz Copper Project in Arizona and the Tintic Copper-Gold Project in Utah, as well as other exploration projects in the United States, we intend to support United States supply chain independence by finding and delivering the critical metals necessary for the electrification of the economy. We also operate a 50/50 joint venture with Saudi Arabian Mining Company Ma’aden to explore for minerals on ~48,500 km2 of underexplored Arabian Shield in the Kingdom of Saudi Arabia. Website: www.ivanhoeelectric.com.

About Sama Resources

Sama Resources is a Canadian-based, growth-oriented resource company focused on exploring the Samapleu-Grata Nickel-Copper Project in Côte d’Ivoire, West Africa. The Company is managed by experienced industry professionals with a strong track record of discovery. Sama’s projects are located approximately 600 km northwest of Abidjan in Côte d’Ivoire and are flanked to the west by the Ivorian and Guinean borders. Sama’s projects are located adjacent to the large world-class nickel-cobalt laterite deposits of Sipilou and Foungouesso, forming a 125 km-long new base metal camp in West Africa. Sama owns 40% interest in the Samapleu-Grata Nickel-Copper Project in Côte d’Ivoire with its joint venture partner Ivanhoe Electric owning 60%.

Contact Information

Investors: (480) 656-5821 or moc.cirtceleeohnavi@ofni

Follow us on Twitter

Ivanhoe Electric’s Executive Chairman Robert Friedland: @robert_ivanhoe

Ivanhoe Electric: @ivanhoeelectric

Ivanhoe Electric’s investor relations website located at www.ivanhoeelectric.com should be considered Ivanhoe Electric’s recognized distribution channel for purposes of the Securities and Exchange Commission’s Regulation FD.

Forward-Looking Statements

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable US and Canadian securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Ivanhoe Electric, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the Ivanhoe Electric’s current expectations regarding future events, performance and results and speak only as of the date of this news release.

Such statements in this news release include, without limitation, all of the results of the 2024 PEA announced by Sama and include future estimates of internal rates of return, net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, and estimates of capital and operating costs as well as statements regarding exploration upside and expansion opportunities at the Project.

Forward-looking statements are based on management’s beliefs and assumptions and on information currently available to management. Such statements are subject to significant risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including changes in the prices of copper or other metals Ivanhoe Electric is exploring for; the results of exploration and drilling activities and/or the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations; the final assessment of exploration results and information that is preliminary; the significant risk and hazards associated with any future mining operations, extensive regulation by the US government as well as local governments; changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with Ivanhoe Electric to perform as agreed; and the impact of political, economic and other uncertainties associated with operating in foreign countries, and the impact of the COVID-19 pandemic and the global economy. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and risk factors described in Ivanhoe Electric’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission.

No assurance can be given that such future results will be achieved. Forward-looking statements speak only as of the date of this news release. Ivanhoe Electric cautions you not to place undue reliance on these forward-looking statements. Subject to applicable securities laws, Ivanhoe Electric does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release, and Ivanhoe Electric expressly disclaims any requirement to do so. No assurance can be given that such future results will be achieved. Forward-looking statements speak only as of the date of this news release. Ivanhoe Electric cautions you not to place undue reliance on these forward-looking statements. Subject to applicable securities laws, Ivanhoe Electric does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release, and Ivanhoe Electric expressly disclaims any requirement to do so.